- LULU stock price is trading inside a dynamic range advancing to higher levels.

- Lululemon Athletica Inc. has a market cap of $53.124B.

Lululemon Athletica Inc. is a multinational athletic apparel retailer and has its headquarters in British Columbia. The current CEO of the company is Calvin R. McDonald and has 34K employees working for it. The company was founded in the year 1998 by Chip Wilson.

Lululemon Athletica Inc. does not pay any dividend to its shareholders which might be pretty disappointing for investors. Despite this, the company has reliable financials as the ratios are in favor of the company. The ROA for the company is 16.81% and the debt/equity ratio of the stock is neutral resulting in 33.78%.

The average volume for the LULU stock for the last 10 days is 1.473M against the last trading session’s volume of 1.39M. The LULU stock has an EPS of 7.92 which denotes that the company is profitable and making money on its each share.

Lululemon Athletica Inc. Stock Performance Analysis

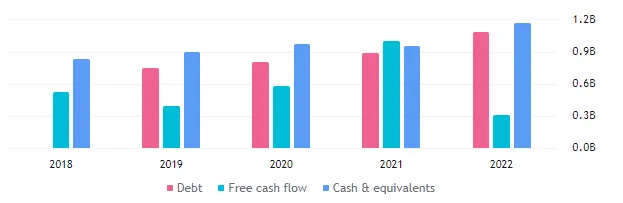

With the advance in revenue of the company, the debt of the company is also rising. Despite this advance in debt, the company has managed to be profitable over the years. The reported debt by the company for the year ending 2022 is $1.07B. This is followed by the revenue of $8.11B.

Will LULU Stock Break Above The Dynamic Trading Range And Achieve New Highs?

Following the volatility in the stock, its price is advancing to higher levels. However, this behavior of the market has led to the formation of the expanding wedge pattern. The LULU stock price is still trading inside the same pattern making higher highs.

The LULU share price is also trading above the 50-day and the 200-day EMA following a golden cross. The LULU stock price is also advancing to higher levels.

The RSI for the LULU stock is trading above the 50-level and has broken out above the 14-day SMA line.

Conclusion

The Lululemon Athletica Inc. is financially strong and has reliable fundamentals. On the technical charts, the LULU stock is trying to make higher highs. If the stock price breaks above the level of $420.00, the price might continue to advance to higher levels.

The company has a very good dividend payout which can be a center of attraction for investors who are looking for passive income. Despite this, the technicals of the stock are extremely negative on the charts and there is no sign of buying in the LULU stock.

Thus, the stock price might continue to decline to lower levels and show further decline in price in the upcoming days.

Technical Levels

- Support levels- $328.50 and $354.70

- Resistance levels- $420.00 and $478.00

Disclaimer

The information provided in this article, including the views and opinions expressed by the author or any individuals mentioned, is intended for informational purposes only. It is important to note that the article does not provide financial or investment advice. Investing or trading in cryptocurrency assets carries inherent risks and can result in financial loss.