- Frasers Group PLC is a British retail, sports, leisure clothing, and intellectual property group. It is named after the department store chain “House of Fraser”.

- This company was founded in 1982 by Mike Ashley. The stock of the company is listed on the London Stock Exchange (LSE).

- According to analysts, the FRAS stock price is volatile which means it can sink lower in the future.

The stock is up by 188.41% in the overall time frame which is very good for any stock.

Profit is expected to grow by 68% in the upcoming years. It might boost the share price in the future.

In this article, we will analyze the stock price through technical evaluation. It will help to withdraw some information from it.

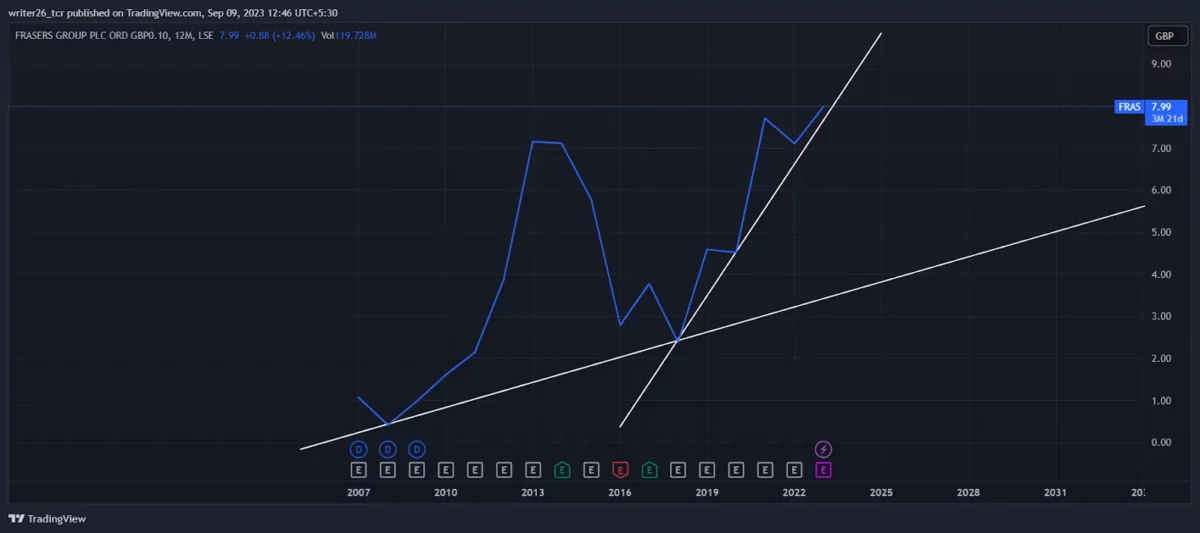

Technical Analysis of the FRAS Stock (Yearly)

Source: LSE: FRAS by Trading View

In the last 5 years, the stock was up by 127.31%. It represents that the stock was performing pretty well in the past.

It retraced in 2015 and 2016, which is normal for any stock as it was not continuously in the downtrend.

The stock bounced back in 2018 and now it is in a very good uptrend. It might take support from the trend line and move up in that direction.

The stock was down by 1.88% last year. The stock seems suitable for a long-term investment.

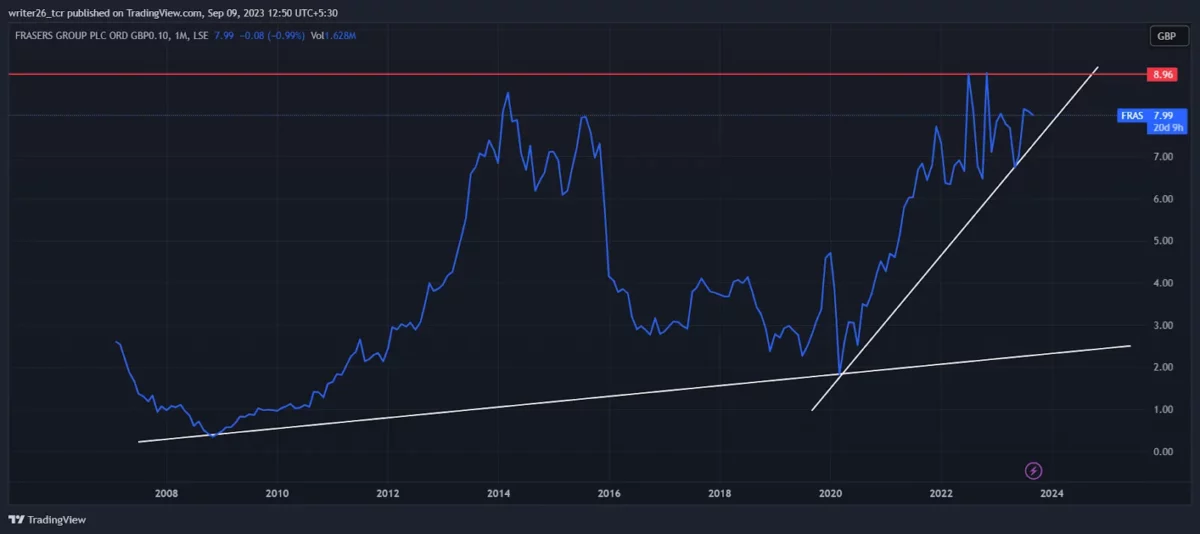

Technical Analysis of the FRAS Stock (Monthly)

Source: LSE: FRAS by Trading View

Near the current market price, the stock might make another support point on the trend line.

It can show some upward movement soon because the stock has maintained that momentum for a long time.

There is a strong resistance level and it is unable to break the level. The breakout will help the stock to make its new all-time high.

It was up by 1.56% in the last 6 months and it was down by (1.40%) last month.

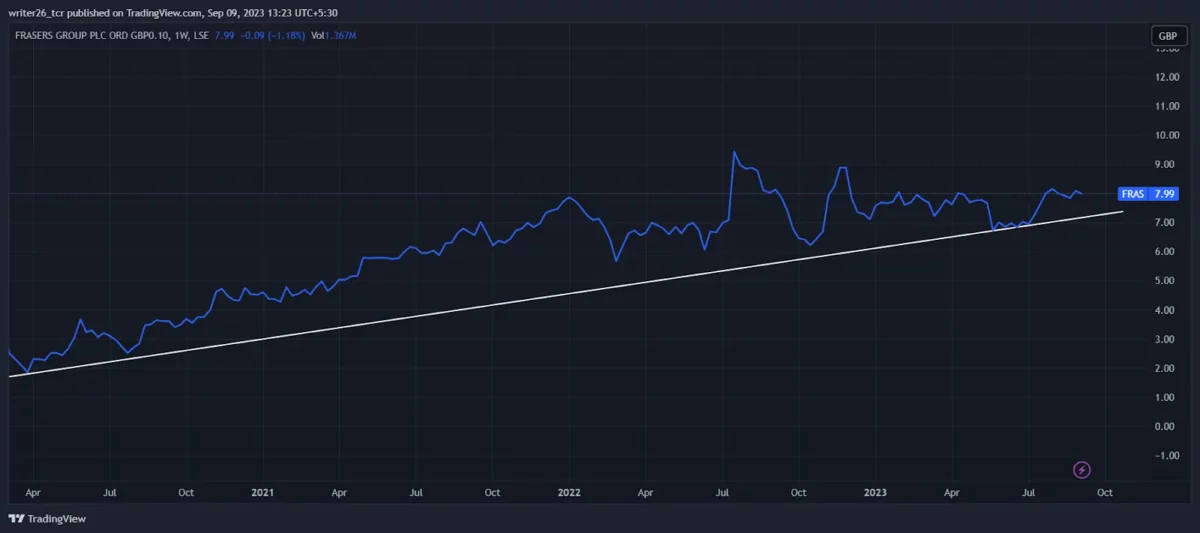

Technical Analysis of the FRAS Stock (Weekly)

Source: LSE: FRAS by Trading View

The weekly time frame shows us that stock is in an uptrend. It may retrace to make another support point on the line.

The stock is very good for large, medium, or small periods. There is an opportunity to invest in the weekly and monthly time frame for investors.

It was down by (2.42%) in the last 5 days. The fall continues until it takes support from the uptrend line.

Technical Analysis of the FRAS Coin (Dailly)

Source: LSE: FRAS by Trading View

We can see that the stock is in a range between the support level and the resistance level.

It is continuously making new resistance points and is unable to break the resistance level.

The chances of short selling are strong because of the reasons explained in this article. Traders can take it as an opportunity.

Conclusion

Through the evaluation of the stock with the help of technical analysis we can withdraw that overall the stock is in an uptrend position.

In the monthly time frame, it was in an upward direction which can help to earn good returns. In the weekly time frame, it is moving up in that direction. It is in a sideways position in the daily time frame.

So, the stock does have the potential to generate a good amount of returns on the investment made by the general public in the yearly and monthly time frame.

Technical Levels

- Resistance Level- £8.15

- Support Level- £6.73

Disclaimer

The analysis is done for providing information through technical analysis and no investment suggestions are given in the article to be made by investors. The stocks need proper study. So investors should have proper knowledge. Stocks are preferred more than the cryptocurrencies. The stocks are very safe for investment purposes. This article does not offer any financial advice. It only describes the movement of the asset.